The 2024 Filing Instructions Guide (FIG) is a compendium of resources to help you file annual HMDA data collected in 2024 with the Consumer Financial Protection Bureau (Bureau) in 2025. These resources are briefly described in this section and are further detailed throughout this document in individual sections.

The HMDA agencies have agreed that filing HMDA data collected in or after 2017 with the Bureau will be deemed as a submission to the appropriate Federal agency. 1

The FIG includes the following sections:

This section provides a summary of the changes made to the submission process for filing HMDA data collected in 2024 with the Bureau.

This section may be useful for employees in a variety of roles, for example, your institution’s:

This section provides information including valid values, how to format your loan/application register, and how to file your HMDA data collected in 2023 with the Bureau.

This section may be useful for employees in a variety of roles, for example, your institution’s:

On October 15, 2015, the Bureau issued a final rule (2015 HMDA Final Rule) Regulation C. In August 2017, the Bureau issued a final rule amending the 2015 HMDA Rule primarily to make technical corrections and clarify amendments (2017 HMDA Final Rule). In August 2018, the Bureau issued an interpretive and procedural rule (2018 HMDA Rule) to implement and clarify the amendments to HMDA made by section 104(a) of the Economic Growth, Regulatory Relief, and Consumer Protection Act (the Act). Beginning with data collected in 2018, HMDA filers should report the data points described in the 2015 HMDA Final Rule and the 2017 HMDA Final Rule, as modified by the 2018 HMDA Rule for insured depository institutions and insured credit unions reporting transactions covered by a partial exemption.

This section provides instructions for what to enter into each data field in the loan/application register.

This section may be useful for employees in a variety of roles, for example, your institution’s:

This section lists the edits that financial institutions must run on HMDA data before filing with the Bureau.

This section may be useful for employees in a variety of roles, for example, your institution’s:

There are no significant changes to the submission process for data collected in 2024 and reported in 2025.

The required data fields for the 2024 data have not changed from the 2023 data collection and reporting requirements. Please refer to Regulation C, the 2018 HMDA Rule, and the Data Specification section for the 2024 requirements.

Financial institutions will submit data collected in a pipe delimited text file (.txt). Data fields will be separated by a pipe character, “|”, and will not be fixed length. Do not include leading zeros for the purpose of making a data field a specific number of characters. Additional information regarding the loan/application register file format can be found in the “Self Service Knowledge Portal” located at https://ffiec.cfpb.gov. For additional questions, contact hmdahelp@cfpb.gov.

Text entries in alphanumeric fields do not need to use all uppercase letters with the exception of:

A loan/application register formatting tool will be provided to help filers format certain data into a pipe delimited text file. This tool may be especially helpful for filers with small volumes of reported loans that do not use vendor or other software to prepare their HMDA data for submission. Information regarding the loan/application register formatting tool will be located at https://ffiec.cfpb.gov.

Filers will submit their HMDA data using a web interface referred to as the HMDA Platform. Information regarding the HMDA Platform can be located at: https://ffiec.cfpb.gov.

We recommend that HMDA filers use a modern browser, such as the latest version of Google Chrome™, Mozilla® Firefox®, Microsoft Edge™, or other modern browsers.

Financial institutions must address all edits prior to submitting their HMDA data. In contrast to the previous process for filing data with the Federal Reserve Board (FRB), all edits must now be addressed prior to filing HMDA data with the Bureau in order to complete the submission process.

A resubmission means that you have already filed your HMDA submission and received a confirmation receipt, but you are submitting again for the same filing year. Beginning with data collected in 2017, filers will resubmit their HMDA data to the Bureau.

As part of the submission process, an authorized representative of your institution with knowledge of the data submitted shall certify to the accuracy and completeness of the data submitted. Filers will not fax or e-mail the signed certification.

Technical questions about reporting HMDA data collected in or after 2017 should be directed to hmdahelp@cfpb.gov.

Technical questions about reporting HMDA data collected in or before 2016 should be directed to hmdahelp@frb.gov.

The following information describes the format used when filing HMDA data with the Bureau.

Filers will submit their HMDA data using a web interface. Information regarding the HMDA Platform can be located at: https://ffiec.cfpb.gov.

The HMDA Platform will walk you through the loan/application register filing process.

Certification will also occur within the HMDA Platform. An authorized representative of your institution with knowledge of the data submitted shall certify to the accuracy and completeness of the data submitted.

Beginning with data collected in 2017, your HMDA data loan/application register will be submitted in a pipe (also referred to as vertical bar) delimited text file format. This means that:

Text entries in alphanumeric fields do not need to use all uppercase letters with the exception of:

As with previous submissions:

Table 1 and Table 2 contain the data field name, data field type, valid values for numeric fields,examples for alphanumeric fields, and the data point name, where applicable. Please refer to Regulation C and the Data Specifications section for details regarding each data field.

Description:

4. Annual submissions for all HMDA filers for covered loans and applications with respect to which final action was taken from January 1st (01/01) and December 31st (12/31) Codes 1, 2, and 3 are used only during quarterly filing by institutions required to report data quarterly [1]. More information on quarterly filing is found in the Supplemental Guide for Quarterly Filers .

Descriptions:

1. Office of the Comptroller of the Currency (OCC)

2. Federal Reserve System (FRS)

3. Federal Deposit Insurance Corporation (FDIC)

5. National Credit Union Administration (NCUA)

7. United States Department of Housing and Urban Development (HUD)

9. Consumer Financial Protection Bureau (Bureau)

Descriptions:

1. Conventional (not insured or guaranteed by FHA, VA, RHS, or FSA)

2. Federal Housing Administration insured (FHA)

3. Veterans Affairs guaranteed (VA)

4. USDA Rural Housing Service or Farm Service Agency guaranteed (RHS or FSA)

Descriptions:

1. Home purchase

2. Home improvement

31. Refinancing

32. Cash-out refinancing

4. Other purpose

5. Not applicable

Descriptions:

1. Loan originated

2. Application approved but not accepted

3. Application denied

4. Application withdrawn by applicant

5. File closed for incompleteness

6. Purchased loan

7. Preapproval request denied

8. Preapproval request approved but not accepted

Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

3. Information not provided by applicant in mail, internet, or telephone application

4. Not applicable

If the Applicant or Borrower did not select any ethnicity(ies), but only provided ethnicity(ies) in the Ethnicity of Applicant or Borrower: Free Form Text Field for Other Hispanic or Latino, either leave this data field blank or enter Code 14.

Ethnicity of Applicant or Borrower: 2 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

If this data field does not contain an entry, leave it blank.

If the Applicant or Borrower provided ethnicity(ies) in the Ethnicity of Applicant or Borrower: Free Form Text Field for Other Hispanic or Latino, and did not select Code 14, either leave this data field blank or enter Code 14.

Ethnicity of Applicant or Borrower: 3 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

If this data field does not contain an entry, leave it blank.

If the Applicant or Borrower provided ethnicity(ies) in the Ethnicity of Applicant or Borrower: Free Form Text Field for Other Hispanic or Latino, and did not select Code 14, either leave this data field blank or enter Code 14.

Ethnicity of Applicant or Borrower: 4 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

If this data field does not contain an entry, leave it blank.

If the Applicant or Borrower provided ethnicity(ies) in the Ethnicity of Applicant or Borrower: Free Form Text Field for Other Hispanic or Latino, and did not select Code 14, either leave this data field blank or enter Code 14.

Ethnicity of Applicant or Borrower: 5 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

If this data field does not contain an entry, leave it blank.

If the Applicant or Borrower provided ethnicity(ies) in the Ethnicity of Applicant or Borrower: Free Form Text Field for Other Hispanic or Latino, and did not select Code 14, either leave this data field blank or enter Code 14.

Ethnicity of Applicant or Borrower: Free Form Text Field for Other Hispanic or Latino Alphanumeric; Width up to 100 charactersSpecify in text the Applicant’s or Borrower’s Other Hispanic or Latino ethnicity(ies) provided by the Applicant or Borrower. Otherwise, leave this data field blank.

Ethnicity of Co-Applicant or Co-Borrower: 1 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

3. Information not provided by applicant in mail, internet, or telephone application

4. Not applicable

5. No co-applicant

If the Co-Applicant or Co-Borrower did not select any ethnicity(ies), but only provided ethnicity(ies) in the Ethnicity of Co-Applicant or Co-Borrower: Free Form Text Field for Other Hispanic or Latino, either leave this this data field blank or enter Code 14.

Ethnicity of Co-Applicant or Co-Borrower: 2 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

If this data field does not contain an entry, leave it blank.

If the Co-Applicant or Co-Borrower provided ethnicity(ies) in the Ethnicity of Co-Applicant or Co-Borrower: Free Form Text Field for Other Hispanic or Latino, and did not select Code 14, either leave this data field blank or enter Code 14.

Ethnicity of Co-Applicant or Co-Borrower: 3 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

If this data field does not contain an entry, leave it blank.

If the Co-Applicant or Co-Borrower provided ethnicity(ies) in the Ethnicity of Co-Applicant or Co-Borrower: Free Form Text Field for Other Hispanic or Latino, and did not select Code 14, either leave this data field blank or enter Code 14.

Ethnicity of Co-Applicant or Co-Borrower: 4 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

If this data field does not contain an entry, leave it blank.

If the Co-Applicant or Co-Borrower provided ethnicity(ies) in the Ethnicity of Co-Applicant or Co-Borrower: Free Form Text Field for Other Hispanic or Latino, and did not select Code 14, either leave this data field blank or enter Code 14.

Ethnicity of Co-Applicant or Co-Borrower: 5 1Descriptions:

1. Hispanic or Latino

11. Mexican

12. Puerto Rican

13. Cuban

14. Other Hispanic or Latino

2. Not Hispanic or Latino

If this data field does not contain an entry, leave it blank.

If the Co-Applicant or Co-Borrower provided ethnicity(ies) in the Ethnicity of Co-Applicant or Co-Borrower: Free Form Text Field for Other Hispanic or Latino, and did not select Code 14, either leave this data field blank or enter Code 14.

Ethnicity of Co-Applicant or Co-Borrower: Free Form Text Field for Other Hispanic or Latino Alphanumeric; Width up to 100 charactersSpecify in text the Co-Applicant’s or Co-Borrower’s Other Hispanic or Latino ethnicity(ies) provided by the Co-Applicant or Co-Borrower. Otherwise, leave this data field blank.

Ethnicity of Applicant or Borrower Collected on the Basis of Visual Observation or SurnameDescriptions:

1. Collected on the basis of visual observation or surname

2. Not collected on the basis of visual observation or surname

3. Not applicable

Descriptions:

1. Collected on the basis of visual observation or surname

2. Not collected on the basis of visual observation or surname

3. Not applicable

4. No co-applicant

Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

6. Information not provided by applicant in mail, internet, or telephone application

7. Not applicable

If the Applicant or Borrower did not select any race(s) and only provided race(s) in the Race of Applicant or Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Applicant or Borrower: Free Form Text Field for Other Asian, and/or Race of Applicant or Borrower: Free Form Text Field for Other Pacific Islander, either leave this data field blank or enter, as appropriate, Code 1, 27, or 44.

Race of Applicant or Borrower: 2 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

If this data field does not contain an entry, leave it blank.

If the Applicant or Borrower provided race(s) in the Race of Applicant or Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Applicant or Borrower: Free Form Text Field for Other Asian, and/or Race of Applicant or Borrower: Free Form Text Field for Other Pacific Islander, and did not select Code 1, 27, or 44, either leave this data field blank or enter Code 1, 27, or 44.

Race of Applicant or Borrower: 3 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

If this data field does not contain an entry, leave it blank.

If the Applicant or Borrower provided race(s) in the Race of Applicant or Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Applicant or Borrower: Free Form Text Field for Other Asian, and/or Race of Applicant or Borrower: Free Form Text Field for Other Pacific Islander, and did not select Code 1, 27, or 44, either leave this data field blank or enter Code 1, 27, or 44.

Race of Applicant or Borrower: 4 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

If this data field does not contain an entry, leave it blank.

If the Applicant or Borrower provided race(s) in the Race of Applicant or Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Applicant or Borrower: Free Form Text Field for Other Asian, and/or Race of Applicant or Borrower: Free Form Text Field for Other Pacific Islander, and did not select Code 1, 27, or 44, either leave this data field blank or enter Code 1, 27, or 44.

Race of Applicant or Borrower: 5 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

If this data field does not contain an entry, leave it blank.

If the Applicant or Borrower provided race(s) in the Race of Applicant or Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Applicant or Borrower: Free Form Text Field for Other Asian, and/or Race of Applicant or Borrower: Free Form Text Field for Other Pacific Islander, and did not select Code 1, 27, or 44, either leave this data field blank or enter Code 1, 27, or 44.

Race of Applicant or Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe

Alphanumeric; Width up to 100 charactersSpecify in text the Applicant’s or Borrower’s American Indian or Alaska Native Enrolled or Principal Tribe if provided by the Applicant or Borrower. Otherwise, leave this data field blank.

Race of Applicant or Borrower: Free Form Text Field for Other Asian Alphanumeric; Width up to 100 charactersSpecify in text the Applicant’s or Borrower’s Other Asian race(s) provided by the Applicant or Borrower. Otherwise, leave this data field blank.

Race of Applicant or Borrower: Free Form Text Field for Other Pacific Islander Alphanumeric; Width up to 100 charactersSpecify in text the Applicant’s or Borrower’s Other Pacific Islander race(s) provided by the Applicant or Borrower. Otherwise, leave this data field blank.

Race of Co-Applicant or Co-Borrower: 1 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

6. Information not provided by applicant in mail, internet, or telephone application

7. Not applicable

8. No co-applicant

If the Co-Applicant or Co-Borrower did not select any race(s) and only provided race(s) in the Race of Co-Applicant or Co-Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Asian, and/or Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Pacific Islander, either leave this data field blank or enter, as appropriate, Code 1, 27, or 44.

Race of Co-Applicant or Co-Borrower: 2 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

If this data field does not contain an entry, leave it blank.

If the Co-Applicant or Co-Borrower provided race(s) in the Race of Co-Applicant or Co-Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Asian, and/or Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Pacific Islander, and did not select Code 1, 27, or 44, either leave this data field blank or enter Code 1, 27, or 44.

Race of Co-Applicant or Co-Borrower: 3 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

If this data field does not contain an entry, leave it blank.

If the Co-Applicant or Co-Borrower provided race(s) in the Race of Co-Applicant or Co-Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Asian, and/or Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Pacific Islander, and did not select Code 1, 27, or 44, either leave this data field blank or enter Code 1, 27, or 44.

Race of Co-Applicant or Co-Borrower: 4 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

If this data field does not contain an entry, leave it blank.

If the Co-Applicant or Co-Borrower provided race(s) in the Race of Co-Applicant or Co-Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Asian, and/or Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Pacific Islander, and did not select Code 1, 27, or 44, either leave this data field blank or enter Code 1, 27, or 44.

Race of Co-Applicant or Co-Borrower: 5 1Descriptions:

1. American Indian or Alaska Native

2. Asian

21. Asian Indian

22. Chinese

23. Filipino

24. Japanese

25. Korean

26. Vietnamese

27. Other Asian

3. Black or African American

4. Native Hawaiian or Other Pacific Islander

41. Native Hawaiian

42. Guamanian or Chamorro

43. Samoan

44. Other Pacific Islander

5. White

If this data field does not contain an entry, leave it blank.

If the Co-Applicant or Co-Borrower provided race(s) in the Race of Co-Applicant or Co-Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Asian, and/or Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Pacific Islander, and did not select Code 1, 27, or 44, either leave this data field blank or enter Code 1, 27, or 44.

Race of Co-Applicant or Co-Borrower: Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe

Alphanumeric; Width up to 100 charactersSpecify in text the Co-Applicant’s or Co-Borrower’s American Indian or Alaska Native Enrolled or Principal Tribe if provided by the Co-Applicant or Co-Borrower. Otherwise, leave this data field blank.

Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Asian Alphanumeric; Width up to 100 charactersSpecify in text the Co-Applicant’s or Co-Borrower’s Other Asian race(s) provided by the Co-Applicant or Co-Borrower. Otherwise, leave this data field blank.

Race of Co-Applicant or Co-Borrower: Free Form Text Field for Other Pacific Islander Alphanumeric; Width up to 100 charactersSpecify in text the Co-Applicant’s or Co-Borrower’s Other Pacific Islander race(s) provided by the Co-Applicant or Co-Borrower. Otherwise, leave this data field blank.

Race of Applicant or Borrower Collected on the Basis of Visual Observation or SurnameDescriptions:

1. Collected on the basis of visual observation or surname

2. Not collected on the basis of visual observation or surname

3. Not applicable

Descriptions:

1. Collected on the basis of visual observation or surname

2. Not collected on the basis of visual observation or surname

3. Not applicable

4. No co-applicant

Descriptions:

1. Male

2. Female

3. Information not provided by applicant in mail, internet, or telephone application

4. Not applicable

6. Applicant selected both male and female

Descriptions:

1. Male

2. Female

3. Information not provided by applicant in mail, internet, or telephone application

4. Not applicable

5. No co-applicant

6. Co-applicant selected both male and female

Descriptions:

1. Collected on the basis of visual observation or surname

2. Not collected on the basis of visual observation or surname

3. Not applicable

Descriptions:

1. Collected on the basis of visual observation or surname

2. Not collected on the basis of visual observation or surname

3. Not applicable

4. No co-applicant

Descriptions:

0. Not applicable

1. Fannie Mae

2. Ginnie Mae

3. Freddie Mac

4. Farmer Mac

5. Private securitizer

6. Commercial bank, savings bank, or savings association

71. Credit union, mortgage company, or finance company

72. Life insurance company

8. Affiliate institution

9. Other type of purchaser

Example: 650 (or) Descriptions:

7777. Credit score is not a number

8888. Not applicable

9999. No co-applicant

1111. Exempt

Descriptions:

1. Equifax Beacon 5.0

2. Experian Fair Isaac Risk Model v2

3. TransUnion FICO Risk Score Classic 04

4. TransUnion FICO Risk Score Classic 98

5. VantageScore 2.0

6. VantageScore 3.0

7. More than one credit scoring model

8. Other credit scoring model

9. Not applicable

11. FICO Score 9

12. FICO Score 8

13. FICO Score 10

14. FICO Score 10T

15. VantageScore 4.0

1111. Exempt

Applicant or Borrower, Name and Version of Credit Scoring Model: Conditional Free Form Text Field for Code 8

Alphanumeric; Width up to 100 charactersSpecify in text the applicant’s or borrower’s Other credit scoring model if 8 is entered. Otherwise, leave this data field blank.

Credit Score Co-Applicant or Co-Borrower, Name and Version of Credit Scoring Model 1Descriptions:

1. Equifax Beacon 5.0

2. Experian Fair Isaac Risk Model v2

3. TransUnion FICO Risk Score Classic 04

4. TransUnion FICO Risk Score Classic 98

5. VantageScore 2.0

6. VantageScore 3.0

7. More than one credit scoring model

8. Other credit scoring model

9. Not applicable

10. No co-applicant

11. FICO Score 9

12. FICO Score 8

13. FICO Score 10

14. FICO Score 10T

15. VantageScore 4.0

1111. Exempt

Co-Applicant or Co-Borrower, Name and Version of Credit Scoring Model: Conditional Free Form Text Field for Code 8

Alphanumeric; Width up to 100 charactersSpecify in text the co-applicant’s or co-borrower’s Other credit scoring model if 8 is entered. Otherwise, leave this data field blank.

Credit Score Reason for Denial: 1 1Descriptions:

1. Debt-to-income ratio

2. Employment history

3. Credit history

4. Collateral

5. Insufficient cash (downpayment, closing costs)

6. Unverifiable information

7. Credit application incomplete

8. Mortgage insurance denied

9. Other

10. Not applicable

1111. Exempt

Descriptions:

1. Debt-to-income ratio

2. Employment history

3. Credit history

4. Collateral

5. Insufficient cash (downpayment, closing costs)

6. Unverifiable information

7. Credit application incomplete

8. Mortgage insurance denied

9. Other

If this data field does not contain an entry, leave it blank

Reason for Denial Reason for Denial: 3 1Descriptions:

1. Debt-to-income ratio

2. Employment history

3. Credit history

4. Collateral

5. Insufficient cash (downpayment, closing costs)

6. Unverifiable information

7. Credit application incomplete

8. Mortgage insurance denied

9. Other

If this data field does not contain an entry, leave it blank

Reason for Denial Reason for Denial: 4 1Descriptions:

1. Debt-to-income ratio

2. Employment history

3. Credit history

4. Collateral

5. Insufficient cash (downpayment, closing costs)

6. Unverifiable information

7. Credit application incomplete

8. Mortgage insurance denied

9. Other

If this data field does not contain an entry, leave it blank

Reason for Denial Reason for Denial: Conditional Free Form Text Field for Code 9 Alphanumeric; Width up to 255 charactersSpecify in text the Other Denial Reason(s) if Code 9 is entered. Otherwise, leave this data field blank.

Reason for Denial Total Loan Costs Alphanumeric Example: 2399.04 (or) NA (or) Exempt Total Loan Costs or Total Points and Fees Total Points and Fees Alphanumeric Example: 2399.04 (or) NA (or) Exempt Total Loan Costs or Total Points and Fees Origination Charges Alphanumeric Example: 2399.04 (or) NA (or) Exempt Origination Charges Discount Points AlphanumericExample: 2399.04 (or) NA (or) Exempt

If no points were paid, leave this data field blank

Discount Points Lender Credits AlphanumericExample: 1500.24 (or) NA (or) Exempt

If no lender credits were provided, leave this data field blank

Lender Credits Interest Rate Alphanumeric Example: 4.125 (or) NA (or) Exempt Interest Rate Prepayment Penalty Term Alphanumeric Example: 24 (or) NA (or) Exempt Prepayment Penalty Term Debt-to-Income Ratio Alphanumeric Example: 42.95 (or) -42.95 (or) NA (or) Exempt Debt-to-Income Ratio Combined Loan-to-Value Ratio Alphanumeric Example: 80.05 (or) NA (or) Exempt Combined Loan-to-Value Ratio Alphanumeric Example: 360 (or) NA (or) Exempt Introductory Rate Period Alphanumeric Example: 24 (or) NA (or) Exempt Introductory Rate Period Balloon Payment Descriptions:Descriptions:

1. Other non-fully amortizing features

2. No other non-fully amortizing features

1111. Exempt

Descriptions:

1. Manufactured home and land

2. Manufactured home and not land

3. Not applicable

1111. Exempt

Descriptions:

1. Direct ownership

2. Indirect ownership

3. Paid leasehold

4. Unpaid leasehold

5. Not applicable

1111. Exempt

Descriptions:

1. Submitted directly to your institution

2. Not submitted directly to your institution

3. Not applicable

1111. Exempt

Descriptions:

1. Initially payable to your institution

2. Not initially payable to your institution

3. Not applicable

1111. Exempt

Descriptions:

1. Desktop Underwriter (DU)

2. Loan Prospector (LP) or Loan Product Advisor

3. Technology Open to Approved Lenders (TOTAL) Scorecard

4. Guaranteed Underwriting System (GUS)

5. Other

6. Not applicable

7. Internal Proprietary System

1111. Exempt

Descriptions:

1. Desktop Underwriter (DU)

2. Loan Prospector (LP) or Loan Product Advisor

3. Technology Open to Approved Lenders (TOTAL) Scorecard

4. Guaranteed Underwriting System (GUS)

5. Other

7. Internal Proprietary System

If this data field does not contain an entry, leave it blank

Automated Underwriting System Automated Underwriting System: 3 1Descriptions:

1. Desktop Underwriter (DU)

2. Loan Prospector (LP) or Loan Product Advisor

3. Technology Open to Approved Lenders (TOTAL) Scorecard

4. Guaranteed Underwriting System (GUS)

5. Other

7. Internal Proprietary System

If this data field does not contain an entry, leave it blank

Automated Underwriting System Automated Underwriting System: 4 1Descriptions:

1. Desktop Underwriter (DU)

2. Loan Prospector (LP) or Loan Product Advisor

3. Technology Open to Approved Lenders (TOTAL) Scorecard

4. Guaranteed Underwriting System (GUS)

5. Other

7. Internal Proprietary System

If this data field does not contain an entry, leave it blank

Automated Underwriting System Automated Underwriting System: 5 1Descriptions:

1. Desktop Underwriter (DU)

2. Loan Prospector (LP) or Loan Product Advisor

3. Technology Open to Approved Lenders (TOTAL) Scorecard

4. Guaranteed Underwriting System (GUS)

5. Other

7. Internal Proprietary System

If this data field does not contain an entry, leave it blank

Automated Underwriting System Automated Underwriting System: Conditional Free Form Text Field for Code 5 Alphanumeric; Width up to 255 charactersSpecify in text the Other Automated Underwriting System(s) if 5 is entered. Otherwise, leave this data field blank.

Automated Underwriting System Automated Underwriting System Result: 1 1Descriptions:

1. Approve/Eligible

2. Approve/Ineligible

3. Refer/Eligible

4. Refer/Ineligible

5. Refer with Caution

6. Out of Scope

7. Error

8. Accept

9. Caution

10. Ineligible

11. Incomplete

12. Invalid

13. Refer

14. Eligible

15. Unable to Determine or Unknown

16. Other

17. Not applicable

18. Accept/Eligible

19. Accept/Ineligible

20. Accept/Unable to Determine

21. Refer with Caution/Eligible

22. Refer with Caution/Ineligible

23. Refer/Unable to Determine

24. Refer with Caution/Unable to Determine

1111. Exempt

Descriptions:

1. Approve/Eligible

2. Approve/Ineligible

3. Refer/Eligible

4. Refer/Ineligible

5. Refer with Caution

6. Out of Scope

7. Error

8. Accept

9. Caution

10. Ineligible

11. Incomplete

12. Invalid

13. Refer

14. Eligible

15. Unable to Determine or Unknown

16. Other

18. Accept/Eligible

19. Accept/Ineligible

20. Accept/Unable to Determine

21. Refer with Caution/Eligible

22. Refer with Caution/Ineligible

23. Refer/Unable to Determine

24. Refer with Caution/Unable to Determine

If this data field does not contain an entry, leave it blank

Automated Underwriting System Automated Underwriting System Result: 3 1Descriptions:

1. Approve/Eligible

2. Approve/Ineligible

3. Refer/Eligible

4. Refer/Ineligible

5. Refer with Caution

6. Out of Scope

7. Error

8. Accept

9. Caution

10. Ineligible

11. Incomplete

12. Invalid

13. Refer

14. Eligible

15. Unable to Determine or Unknown

16. Other

18. Accept/Eligible

19. Accept/Ineligible

20. Accept/Unable to Determine

21. Refer with Caution/Eligible

22. Refer with Caution/Ineligible

23. Refer/Unable to Determine

24. Refer with Caution/Unable to Determine

If this data field does not contain an entry, leave it blank

Automated Underwriting System Automated Underwriting System Result: 4 1Descriptions:

1. Approve/Eligible

2. Approve/Ineligible

3. Refer/Eligible

4. Refer/Ineligible

5. Refer with Caution

6. Out of Scope

7. Error

8. Accept

9. Caution

10. Ineligible

11. Incomplete

12. Invalid

13. Refer

14. Eligible

15. Unable to Determine or Unknown

16. Other

18. Accept/Eligible

19. Accept/Ineligible

20. Accept/Unable to Determine

21. Refer with Caution/Eligible

22. Refer with Caution/Ineligible

23. Refer/Unable to Determine

24. Refer with Caution/Unable to Determine

If this data field does not contain an entry, leave it blank

Automated Underwriting System Automated Underwriting System Result: 5 1Descriptions:

1. Approve/Eligible

2. Approve/Ineligible

3. Refer/Eligible

4. Refer/Ineligible

5. Refer with Caution

6. Out of Scope

7. Error

8. Accept

9. Caution

10. Ineligible

11. Incomplete

12. Invalid

13. Refer

14. Eligible

15. Unable to Determine or Unknown

16. Other

18. Accept/Eligible

19. Accept/Ineligible

20. Accept/Unable to Determine

21. Refer with Caution/Eligible

22. Refer with Caution/Ineligible

23. Refer/Unable to Determine

24. Refer with Caution/Unable to Determine

If this data field does not contain an entry, leave it blank

Automated Underwriting System Automated Underwriting System Result: Conditional Free Form Text Field for Code 16 Alphanumeric; Width up to 255 charactersSpecify in text the Other Automated Underwriting System Result(s) if 16 is entered. Otherwise, leave this data field blank.

Automated Underwriting System Reverse Mortgage Descriptions:Descriptions:

1. Primarily for a business or commercial purpose

2. Not primarily for a business or commercial purpose

1111. Exempt

3: Reporting of the State data field is subject to the requirements of both Property Address, provided in 1003.4(a)(9)(i), and Property Location, provided in 1003.4(a)(9)(ii).

This section provides instructions on entering data in the loan/application register for HMDA data collected in 2024. This document is not a substitute for Regulation C. Refer to Regulation C for a complete explanation of the reporting requirement for each data field.

Data fields are presented in the order they are recorded in the loan/application register. Data fields are identified by the corresponding 2024 File Specifications table and data field number, followed by the Regulation C paragraph containing the relevant reporting requirements. For example, (1-2) Paragraph 5(a)(3)(i) refers to the data field listed in table 1, data field 2 in the 2023 File Specifications document, and the reporting requirement found at 12 CFR § 1003.5(a)(3)(i). The blue underlined words provide hyperlinks to the referenced Regulation C paragraph.

Please provide the following information regarding your institution in the format described in each paragraph below.

Enter the name of the financial institution that is submitting HMDA data.

Example: If the submission contains HMDA data for Ficus Bank, enter Ficus Bank.

Example: If the data covers calendar year 2023, enter 2023.

Code 4—Annual submissions for covered loans and applications with respect to which final action was taken from January 1 (01/01) and December 31 (12/31)

a. Codes for individual calendar quarters (1-3) are used only by financial institutions required to report HMDA data quarterly effective January 1, 2020. Further instructions for reporting quarterly data can be found in the Supplemental Guide for Quarterly Filers.

Enter the name, telephone number, e-mail address, and office address of a person who may be contacted with questions about your institution's submission.

Example: If the contact person's name is Erika Otis, enter Erika Otis.

Example: If the phone number is (999) 999-9999, enter 999-999-9999. 3. Contact Person's E-mail Address.

a. Contact Person's Office Street Address. Enter the street address of the contact person's office as one (1) data field. U.S. Postal Service Publication 28, Sub-Sections 231–239 can be used as a guide for formatting the street address. Address components include, as applicable, the following individual items:

Example:

4321 W Random Blvd Ste 201

Primary Address Number: "4321"

Predirectional: "W"

Street Name: "Random"

Suffix: "Blvd"

Secondary Address Identifier: "Ste"

Secondary Address: "201"

a. Contact Person's Office City. Enter the city of the contact person's office as one (1) data field.

b. Contact Person's Office State. Enter the two-letter state code of the contact person's office as one (1) data field.

c. Contact Person's Office ZIP Code. Enter the ZIP code of the contact person's office as one (1) data field.

d. Non-Standard Addressing. U.S. Postal Service Publication 28, Sub-Sections 24, 25, and 29, respectively, can be used as guides for formatting non-standard style addressing including rural route, Highway Contract Route, and Puerto Rico addresses.

e. The following address formats are generally not preferred:

Indicate your financial institution's appropriate Federal agency by entering the applicable Code from the following:

Code 1—Office of the Comptroller of the Currency (OCC)

Code 2—Federal Reserve System (FRS)

Code 3—Federal Deposit Insurance Corporation (FDIC)

Code 5—National Credit Union Administration (NCUA)

Code 7—United States Department of Housing and Urban Development (HUD)

Code 9—Consumer Financial Protection Bureau (Bureau)

Enter, in numeral form, the total number of entries contained in the submission.

Example: If your institution is submitting 5,000 entries, enter 5000.

Enter your financial institution's Federal Taxpayer Identification Number.

Example: If your institution's Federal Taxpayer Identification number is 99-9999999, enter 99-9999999.

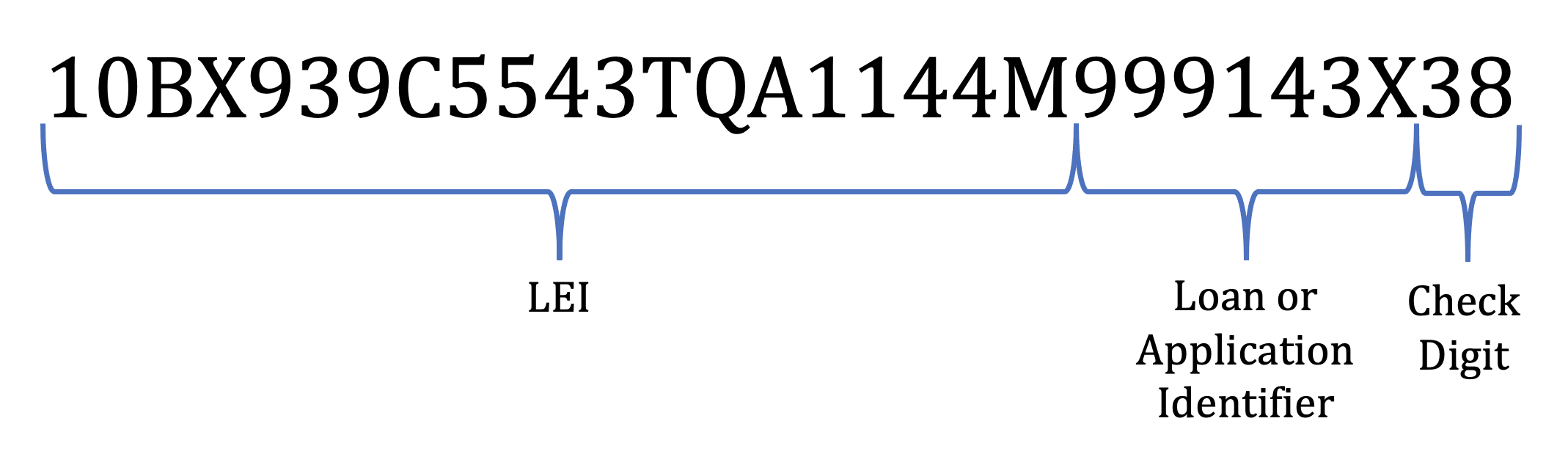

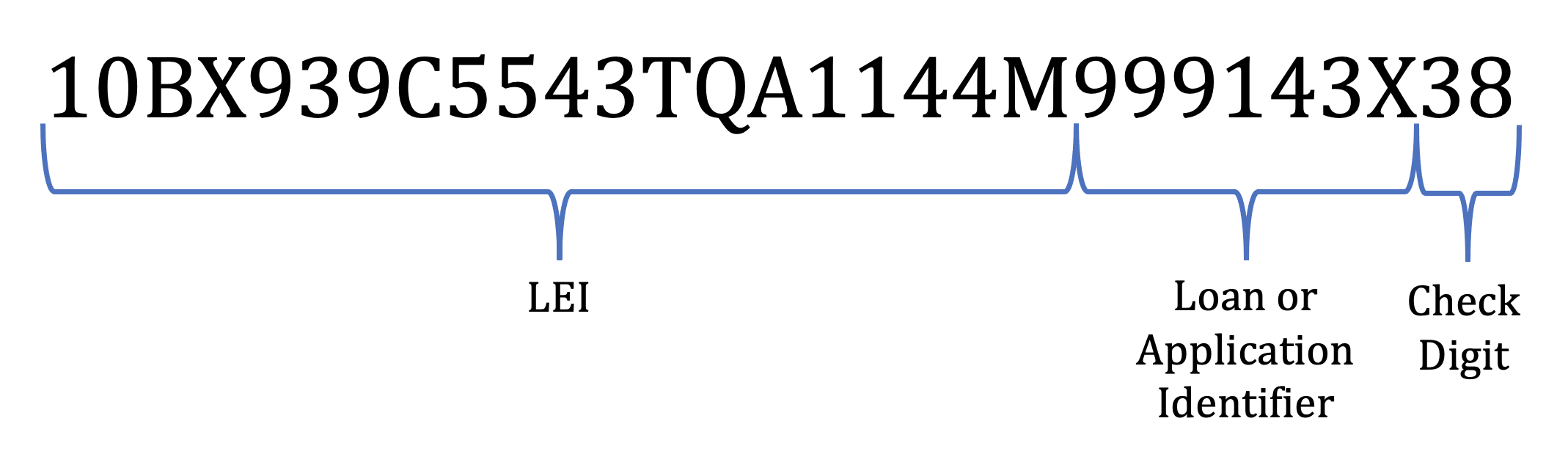

Enter your financial institution's LEI as defined in Paragraph 4(a)(1)(i)(A).

Example: If your institution's LEI is 10BX939C5543TQA1144M, enter 10BX939C5543TQA1144M.

Please provide the following data fields for each application for a covered loan your institution receives, each covered loan that your institution originates, and each covered loan that your institution purchases in the format described in each paragraph below.

Enter the ULI assigned to the covered loan or application. Your financial institution shall assign and report a ULI that:

Enter, in numeral form, the date the application was received or the date shown on the application form by year, month, and day, using YYYYMMDD format.

Example: If the application was received on July 21, 2023, enter 20230721.

a. Enter "NA" if the requirement to report application date is not applicable to the covered loan or application that your institution is reporting.

Indicate the type of covered loan or application by entering the applicable Code from the following:

Code 1—Conventional (not insured or guaranteed by FHA, VA, RHS, or FSA)

Code 2—Federal Housing Administration insured (FHA)

Code 3—Veterans Affairs guaranteed (VA)

Code 4—USDA Rural Housing Service or Farm Service Agency guaranteed (RHS or FSA)

Indicate the purpose of the covered loan or application by entering the applicable Code from the following:

Code 1—Home purchase

Code 2—Home improvement

Code 32—Cash-out refinancing

Code 4—Other purpose

Code 5—Not applicable

Indicate whether the covered loan or application involved a request for a preapproval of a home purchase loan under a preapproval program by entering the applicable Code from the following:

Code 1—Preapproval requested

Code 2—Preapproval not requested

Indicate the construction method for the dwelling by entering the applicable Code from the following:

Code 2—Manufactured home

Indicate the occupancy type by entering the applicable Code from the following:

Code 1—Principal residence

Code 2—Second residence

Code 3—Investment property

Enter, in dollars, the amount of the covered loan, or the amount applied for, as applicable.

Example: If the loan amount is $110,500, enter 110500 or 110500.00. If the loan amount is $110,500.24, enter 110500.24.

Indicate the action taken on the covered loan or application by entering the applicable Code from the following:

Code 1—Loan originated

Code 2—Application approved but not accepted

Code 3—Application denied

Code 4—Application withdrawn by applicant

Code 5—File closed for incompleteness

Code 6—Purchased loan

Code 7—Preapproval request denied

Code 8—Preapproval request approved but not accepted

Enter, in numeral form, the date of action taken by year, month, and day, using YYYYMMDD format.

Example: If the action taken date is July 21, 2023, enter 20230721.

Enter the location of the property securing the covered loan or, in the case of an application, proposed to secure the covered loan.

456 W Somewhere Ave Apt 201

a. Non-Standard Addressing. U.S. Postal Service Publication 28, Sub-Section 24, 25, and 29, respectively, can be used as guides for formatting non-standard style addressing including rural route, Highway Contract Route, and Puerto Rico addresses to increase the accuracy for geocoding.

b. The following address formats are generally not preferred:

General Delivery addresses, such as General Delivery, Anytown, CA 90049-9998.

Post Office Box addresses, such as P.O. Box 100 Anytown, CA 90049-9998.

Spelled-out numbers, such as Four Hundred Fifty Six W Somewhere Ave Apt Two Hundred One.

c. Enter "NA" in each of the property address fields if the requirement to report property address is not applicable to the covered loan or application that your institution is reporting.

d. Enter "Exempt" in the Street Address, City and Zip Code fields if, pursuant to the 2018 HMDA Rule, your institution is not reporting Property Address.

Example: Enter 06037 for the FIPS code for Los Angeles County, CA.

a. Enter "NA" if the requirement to report county is not applicable to the covered loan or application that your institution is reporting.

Example: Enter 06037264000 for a census tract within Los Angeles County, CA.

a. Enter "NA" if the requirement to report census tract is not applicable to the covered loan or application that your institution is reporting.

Appendix B to Regulation C contains instructions for the collection of data on ethnicity, race, and sex, and contains a sample data-collection form.

Code 1—Hispanic or Latino

Code 14—Other Hispanic or Latino

Code 2—Not Hispanic or Latino

Code 3—Information not provided by applicant in mail, internet, or telephone application

Code 4—Not applicable

Code 5—No co-applicant

a. Do not enter the same code more than once for the applicant or borrower, or any co-applicant or co-borrower, as applicable, for any covered loan or application.

b. Use Code 3 if the applicant or borrower, or co-applicant or co-borrower, does not provide the information in an application taken by mail, internet, or telephone. Leave the remaining Ethnicity of Applicant or Borrower data fields blank.

c. Use Code 4 if the requirement to report the applicant's or borrower's ethnicity does not apply to the covered loan or application that your institution is reporting. Leave the remaining Ethnicity of Applicant or Borrower data fields blank.

d. Use Code 5 in the co-applicant field if there are no co-applicants or co-borrowers. Leave the remaining Ethnicity of Applicant or Borrower data fields blank.

i. If there is more than one co-applicant or co-borrower, provide the required information only for the first co-applicant or co-borrower listed on the collection form.

e. If fewer than five (5) ethnicities are provided by the applicant or borrower, or by any co-applicant or co-borrower, leave the remaining Ethnicity of Applicant or Borrower data fields blank.

f. If the applicant or borrower, or any co-applicant or co-borrower, did not select Code 14, but provided another Hispanic or Latino ethnicity(ies) in the Ethnicity Free Form Text Field for Other Hispanic or Latino, your institution is permitted, but not required, to report Code 14 in one of the Ethnicity of Applicant or Borrower data fields. This will be counted as one of the five (5) reported ethnicities, whether or not you also choose to report Code 14 as one of the Ethnicity of Applicant or Borrower, or Ethnicity of Co-Applicant or Co-Borrower, data fields.

Code 1—Collected on the basis of visual observation or surname

Code 2—Not collected on the basis of visual observation or surname

Code 3—Not applicable

Code 4—No co-applicant

a. Use Code 3 if the requirement to report the applicant's or borrower's ethnicity does not apply to the covered loan or application that your institution is reporting.

b. Use Code 3 if the financial institution received the application prior to January 1st, 2018, and the financial institution chooses not to report whether the ethnicity of the applicant or borrower, or of the first co-applicant or co-borrower, as applicable, was collected on the basis of visual observation or surname.

c. Use Code 4 in the co-applicant field if there are no co-applicants or co-borrowers.

i. If there is more than one co-applicant or co-borrower, provide the required information only for the first co-applicant or co-borrower listed on the collection form.

Code 1—American Indian or Alaska Native

Code 3—Black or African American

Code 4—Native Hawaiian or Other Pacific Islander

Code 6—Information not provided by applicant in mail, internet, or telephone application

Code 7—Not applicable

Code 8—No co-applicant

a. Do not enter the same code more than once for the applicant or borrower, or any co-applicant or co-borrower, as applicable, for any covered loan or application.

b. Use Code 6 if the applicant or borrower, or co-applicant or co-borrower, does not provide the information in an application taken by mail, internet, or telephone. Leave the remaining Race of Applicant or Borrower data fields blank.

c. Use Code 7 if the requirement to report the applicant's or borrower's race does not apply to the covered loan or application that your institution is reporting. Leave the remaining Race of Applicant or Borrower data fields blank.

d. Use Code 8 in the co-applicant field if there are no co-applicants or co-borrowers. Leave the remaining Race of Applicant or Borrower data fields blank.

i. If there is more than one co-applicant or co-borrower, provide the required information only for the first co-applicant or co-borrower listed on the collection form.

e. If fewer than five (5) races are provided by the applicant or borrower, or by any co-applicant or co-borrower, leave the remaining Race of Applicant or Borrower data fields blank.

f. If the applicant or borrower, or any co-applicant or co-borrower, did not select Code(s) 1, 27, or 44, but provided the name of the applicant's or borrower's American Indian or Alaska Native Enrolled or Principal Tribe(s) in the Race Free Form Text Field for American Indian or Alaska Native Enrolled or Principal Tribe, other Asian race(s) in the Race Free Form Text Field for Other Asian, or Other Pacific Islander race(s) in the Race Free Form Text Field for Other Pacific Islander, your institution is permitted, but not required, to report Code 1, Code 27, or Code 44, as applicable, in one of the Race of Applicant or Borrower data fields. Each reported race will be counted as one of the five (5) reported races, whether or not you also choose to report Code 1, Code 27, or Code 44, as applicable as one of the Race of Applicant or Borrower, or Race of Co-Applicant or Co-Borrower, data fields.

Code 1—Collected on the basis of visual observation or surname

Code 2—Not collected on the basis of visual observation or surname

Code 3—Not applicable

Code 4—No co-applicant

a. Use Code 3 if the requirement to report the applicant's or borrower's race does not apply to the covered loan or application that your institution is reporting.

b. Use Code 3 if the financial institution received the application prior to January 1st, 2018, and the financial institution chooses not to report whether the race of the applicant or borrower, or of the first co-applicant or co-borrower, as applicable, was collected on the basis of visual observation or surname.

c. Use Code 4 in the co-applicant field if there are no co-applicants or co-borrowers.

i. If there is more than one co-applicant or co-borrower, provide the required information only for the first co-applicant or co-borrower listed on the collection form.

Code 3—Information not provided by applicant in mail, internet, or telephone application

Code 4—Not applicable

Code 5—No co-applicant

Code 6—Applicant selected both male and female

a. Use Code 3 if the applicant or co-applicant does not provide the information in an application taken by mail, internet, or telephone.

b. Use Code 4 if the requirement to report the applicant's or borrower's sex does not apply to the covered loan or application that your institution is reporting.

c. Use Code 5 in the co-applicant field if there are no co-applicants or co-borrowers.

i. If there is more than one co-applicant or co-borrower, provide the required information only for the first co-applicant or co-borrower listed on the collection form.

d. Use Code 6 if the applicant or co-applicant selected both male and female.

Code 1—Collected on the basis of visual observation or surname

Code 2—Not collected on the basis of visual observation or surname

Code 3—Not applicable

Code 4—No co-applicant

a. Use Code 3 if the requirement to report the applicant's or borrower's sex does not apply to the covered loan or application that your institution is reporting.

b. Use Code 3 if the financial institution received the application prior to January 1st, 2018, and the financial institution chooses not to report whether the sex of the applicant or borrower, or of the first co-applicant or co-borrower, as applicable, was collected on the basis of visual observation or surname.

c. Use Code 4 in the co-applicant field if there are no co-applicants or co-borrowers.

i. If there is more than one co-applicant or co-borrower, provide the required information only for the first co-applicant or co-borrower listed on the collection form.

Enter, in numeral form, the age, in years, of the applicant or borrower, or of the first co-applicant or co-borrower, as applicable. Age is calculated, as of the application date, as the number of whole years derived from the date of birth shown on the application form. Or enter the applicable Code from the following:

Code 8888—Not applicable

Code 9999—No co-applicant

Example: If the applicant or borrower is 24 years old, enter 24.

a. Use Code 8888 if the requirement to report the applicant's or borrower's age does not apply to the covered loan or application that your institution is reporting.

b. Use Code 9999 in the co-applicant field if there are no co-applicants or co-borrowers.

i. If there is more than one co-applicant or co-borrower, provide the required information only for the first co-applicant or co-borrower listed on the collection form.

Enter, in dollars, rounded to the nearest thousand, the gross annual income relied on in making the credit decision, or if a credit decision was not made, the gross annual income relied on in processing the application (round $500 up to the next $1,000). The HMDA Platform can accept negative numbers for Income.

Example: If the income amount is $35,500, enter 36. If the income amount is $50,000, enter 50.

a. Enter "NA" if the requirement to report gross annual income does not apply to the covered loan or application that your institution is reporting.

Indicate the type of entity purchasing a covered loan from your institution within the same calendar year that your institution originated or purchased the loan by entering the applicable Code from the following:

Code 0—Not applicable

Code 1—Fannie Mae

Code 2—Ginnie Mae

Code 3—Freddie Mac

Code 4—Farmer Mac

Code 5—Private securitizer

Code 6—Commercial bank, savings bank, or savings association

Code 71—Credit union, mortgage company, or finance company

Code 72—Life insurance company

Code 8—Affiliate institution

Code 9—Other type of purchaser

a. Use Code 0 if the requirement to report the type of purchaser does not apply to the covered loan that your institution is reporting.

Enter, as a percentage, to at least three (3) decimal places, the difference between the covered loan's annual percentage rate (APR) and the average prime offer rate (APOR) for a comparable transaction as of the date the interest rate is set. Numbers calculated to beyond three (3) decimal places may either be reported beyond three (3) decimal places, up to 15 decimal places, or rounded or truncated to three (3) decimal places. Decimal place trailing zeros may either be included or omitted. The HMDA Platform can accept negative numbers for Rate Spread.

a. If the APR exceeds the APOR, enter a positive number.

If the APR is 3.678% and the APOR is 3.25%, enter 0.428.

If the APR is 4.560% and the APOR is 4.25%, enter either 0.31 or 0.310

b. If the APR is less than the APOR, enter a negative number.

If the APR 3.1235% and the APOR is 3.25%, enter -0.1265. Alternatively, the rate spread may be truncated to -0.126 or rounded to -0.127.

c. Enter "NA" if the requirement to report rate spread does not apply to the covered loan or application that your institution is reporting.

d. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Rate Spread.

Indicate whether the covered loan is a high-cost mortgage under Regulation Z, 12 CFR 1026.32(a) by entering the applicable Code from the following:

Code 1—High-cost mortgage

Code 2—Not a high-cost mortgage

Code 3—Not applicable

a. Use Code 3 if the requirement to report HOEPA status does not apply to the covered loan that your institution is reporting.

Indicate the lien status of the property securing the covered loan, or in the case of an application, proposed to secure the covered loan, by entering the applicable Code from the following:

Code 1—Secured by a first lien

Code 2—Secured by a subordinate lien

Code 7777—Credit score is not a number

Code 8888—Not applicable

Code 9999—No co-applicant

Example: If the credit score is 650, enter 650.

a. Use Code 8888 if the requirement to report the credit score does not apply to the covered loan or application that your institution is reporting.

i. If Regulation C requires your institution to report a single score for a covered loan or application involving multiple applicants or borrowers, either report the credit score in the applicant field and use Code 8888 in the co-applicant field or report the credit score in the co-applicant field and use Code 8888 in the applicant field.

b. Use Code 9999 in the co-applicant field if there are no co-applicants or co-borrowers.

c. Use Code 7777 if your institution relied on a credit score that is not a number (e.g., a credit score of "Meets Threshold"). Code 7777 should not be used if a credit scoring model that produces numeric credit scores returns a result stating that the credit score could not be determined.

d. Enter "1111" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Credit Score.

Code 1—Equifax Beacon 5.0

Code 2—Experian Fair Isaac Risk Model v2

Code 3—TransUnion FICO Risk Score Classic 04

Code 4—TransUnion FICO Risk Score Classic 98

Code 5—VantageScore 2.0

Code 6—VantageScore 3.0

Code 7—More than one credit scoring model

Code 8—Other credit scoring model

Code 9—Not applicable

Code 10—No co-applicant

Code 11—FICO Score 9

Code 12-FICO Score 8

Code 13-FICO Score 10

Code 14-FICO Score 10T

Code 15-VantageScore 4.0

a. Use Code 1 for Equifax Beacon 5.0, which may also be known as FICO Score 5.

b. Use Code 2 for Experian Fair/Isaac Risk Model v2, which may also be known as FICO Score 2 or FICO Classic v2.

c. Use Code 3 for TransUnion FICO Risk Score Classic 04, which may also be known as FICO Score 4 or TU-04.

d. Use Code 4 for TransUnion FICO Risk Score Classic 98, which may also be known as FICO 98 or TU-98.

e. Use Code 9 if the requirement to report the name and version of the credit scoring model does not apply to the covered loan or application that your institution is reporting.

i. If Regulation C requires your institution to report a single score for a covered loan or application involving multiple applicants or borrowers, either report the name and version of the credit scoring model, or that multiple credit scoring models were used, in the applicant field, and use Code 9 in the co-applicant field; or report the name and version of the credit scoring model, or that multiple credit scoring models were used, in the co-applicant field and use Code 9 in the applicant field.

f. Use Code 10 in the co-applicant field if there are no co-applicants or co-borrowers.

g. Use Code 11 for FICO Score 9, which also may be known as FICO 9.

h. Use Code 12 for FICO Score 8, which also may be known as FICO 8.

i. Use Code 13 for FICO Score 10, which also may be known as FICO 10.

j. Use Code 14 for FICO Score 10T, which also may be known as FICO 10T.

k. Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Credit Score.

Code 1—Debt-to-income ratio

Code 2—Employment history

Code 3—Credit history

Code 5—Insufficient cash (downpayment, closing costs)

Code 6—Unverifiable information

Code 7—Credit application incomplete

Code 8—Mortgage insurance denied

Code 10—Not applicable

a. Do not enter the same code more than once for any covered loan or application.

b. Use Code 10 if the requirement to report reasons for denial does not apply to the covered loan or application that your institution is reporting. Leave the remaining Reason for Denial data fields blank.

c. Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Reason for Denial. Leave the remaining Reason for Denial data fields blank.

d. If there are fewer than four principal (4) reasons for denial, leave the remaining Reason for Denial data fields blank.

e. If your institution uses the model form contained in Appendix C to Regulation B, 12 CFR part 1002 (Form C–1, Sample Notice of Action Taken and Statement of Reasons), use the foregoing Codes as follows:

Code 1—Income insufficient for amount of credit requested, and Excessive obligations in relation to income

Code 2—Temporary or irregular employment, and Length of employment

Code 3—Insufficient number of credit references provided; Unacceptable type of credit references provided; No credit file; Limited credit experience; Poor credit performance with us; Delinquent past or present credit obligations with others; Number of recent inquiries on credit bureau report; Garnishment, attachment, foreclosure, repossession, collection action, or judgment; and Bankruptcy

Code 4—Value or type of collateral not sufficient

Code 6—Unable to verify credit references; Unable to verify employment; Unable to verify income; and Unable to verify residence

Code 7—Credit application incomplete

Code 9—Length of residence; Temporary residence; and Other reasons specified on the adverse action notice.

Enter either Total Loan Costs or Total Points and Fees or indicate that neither reporting requirement applies by entering "NA" for both.

Enter, in dollars, the amount of total loan costs. If the amount is zero, enter 0.

Example: If the total loan costs are $2,399.04, enter 2399.04.

a. Enter "NA" if the requirement to report total loan costs does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Total Loan Costs or Total Points and Fees.

Enter, in dollars, the total points and fees charged in connection with the covered loan. If the amount is zero, enter 0.

Example: If the total points and fees are $2,399.04, enter 2399.04.

c. Enter "NA" if the requirement to report total points and fees does not apply to the covered loan or application that your institution is reporting.

d. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Total Loan Costs or Total Points and Fees.

Enter, in dollars, the total of all itemized amounts that are designated borrower-paid at or before closing. If the total is zero, enter 0.

Example: If the origination charges are $2,399.04, enter 2399.04.

a. Enter "NA" if the requirement to report origination charges does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Total Loan Costs or Total Points and Fees.

Enter, in dollars, the points paid to the creditor to reduce the interest rate. If no points were paid, leave this field blank.

Example: If the amount paid for discount points is $2,399.04, enter 2399.04.

a. Enter "NA" if the requirement to report discount points does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Discount Points.

Enter, in dollars, the amount of lender credits. If no lender credits were provided, leave this field blank.

Example: If the amount is $1500.24, enter 1500.24.

a. Enter "NA" if the requirement to report lender credits does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Lender Credits.

Enter, as a percentage, to at least three (3) decimal places, the interest rate. Numbers calculated to beyond three (3) decimal places may either be reported beyond three (3) decimal places or rounded or truncated to three (3) decimal places. Decimal place trailing zeros may either be included or omitted. The HMDA Platform can accept up to 15 decimal places for the Interest Rate.

Example: If the interest rate is 4.125%, enter 4.125.

If the interest rate is exactly 4.500%, enter 4.5, 4.50, or 4.500.

a. Enter "NA" if the requirement to report interest rate does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Interest Rate.

c. Enter 0 if the interest rate is 0.

Enter, in numeral form, the term, in months, of any prepayment penalty.

Example: If a prepayment penalty may be imposed within the first 24 months after closing or account opening, enter 24.

a. Enter "NA" if the requirement to report prepayment penalty term does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Prepayment Penalty Term.

Enter, as a percentage, the ratio of the applicant's or borrower's total monthly debt to the total monthly income relied on in making the credit decision. Use decimal places only if the ratio relied upon uses decimal places. The HMDA Platform can accept up to 15 decimal places and can accept negative numbers for Debt-to-Income Ratio.

Example: If the relied upon debt-to-income ratio is 42.95, enter 42.95, and not 43.

If, however, your institution rounded the ratio up to 43% and relied on the rounded-up number, enter 43.

a. Enter "NA" if the requirement to report debt-to-income ratio does not apply to the covered loan or application that your institution is reporting. b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Debt-to-Income Ratio.

Enter, as a percentage, the ratio of the total amount of debt secured by the property to the value of the property relied on in making the credit decision. Use decimal places only if the ratio relied upon uses decimal places. The HMDA Platform can accept up to 15 decimal places for the Combined Loan-to-Value Ratio.

Example: If the relied upon combined loan-to-value ratio is 80.05, enter 80.05, and not 80.

If, however, your institution rounded the ratio down to 80 and relied on the rounded-down number, enter 80.

a. Enter "NA" if the requirement to report combined loan-to-value ratio does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Combined Loan-to-Value Ratio.

Enter, in numeral form, the number of months after which the legal obligation will mature or terminate, or would have matured or terminated.

Example: If the loan term is 360 months, enter 360.

a. Enter "NA" if the requirement to report loan term does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Loan Term.

Enter, in numeral form, the number of months, or proposed number of months in the case of an application, until the first date the interest rate may change after closing or account opening.

Example: If the introductory rate period is 24 months, enter 24.

a. Enter "NA" if the requirement to report introductory rate period does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Introductory Rate Period.

Indicate whether the contractual terms include, or would have included, a balloon payment by entering the applicable Code from the following:

Code 1—Balloon payment

Code 2—No balloon payment

Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Balloon Payment.

Indicate whether the contractual terms include, or would have included, interest-only payments by entering the applicable Code from the following:

Code 1—Interest-only payments

Code 2—No interest-only payments

Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Interest-Only Payments.

Indicate whether the contractual terms include, or would have included, a term that would cause the covered loan to be a negative amortization loan by entering the applicable Code from the following:

Code 1—Negative amortization

Code 2—No negative amortization

Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Negative Amortization.

Indicate whether the contractual terms include, or would have included, any term, other than those described in Paragraphs 1003.4(a)(27)(i), (ii), and (iii) that would allow for payments other than fully amortizing payments during the loan term by entering the applicable Code from the following:

Code 1—Other non-fully amortizing features

Code 2—No other non-fully amortizing features

Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Other Non-Amortizing Features.

Enter, in dollars, the value of the property securing the covered loan or, in the case of an application, proposed to secure the covered loan, relied on in making the credit decision.

Example: If the property value is $350,500, enter 350500.

a. Enter "NA" if the requirement to report property value does not apply to the covered loan or application that your institution is reporting.

b. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Property Value.

Indicate whether the covered loan or application is, or would have been, secured by a manufactured home and land, or by a manufactured home and not land, by entering the applicable Code from the following:

Code 1—Manufactured home and land

Code 2—Manufactured home and not land

Code 3—Not applicable

a. Use Code 3 if the requirement to report manufactured home secured property type does not apply to the covered loan or application that your institution is reporting.

b. Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Manufactured Home Secured Property Type.

Indicate the applicant's or borrower's land property interest in the land on which a manufactured home is, or will be, located by entering the applicable Code from the following:

Code 1—Direct ownership

Code 2—Indirect ownership

Code 3—Paid leasehold

Code 4—Unpaid leasehold

Code 5—Not applicable

a. Use Code 5 if the requirement to report manufactured home land property interest does not apply to the covered loan or application that your institution is reporting.

b. Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Manufactured Home Land Property Interest.

Enter, in numeral form, the number of individual dwelling units related to the property securing the covered loan or, in the case of an application, proposed to secure the covered loan.

Example: If there are five (5) individual dwelling units, enter 5. 4.

Enter, in numeral form, the number of individual dwelling units related to any multifamily dwelling property securing the covered loan or, in the case of an application, proposed to secure the covered loan, that are income-restricted pursuant to Federal, State, or local affordable housing programs.

Example: If there are five (5) multifamily affordable units, enter 5.

a. Enter "0" for a covered loan or application related to a multifamily dwelling that does not contain any such income-restricted individual dwelling units.

b. Enter "NA" if the requirement to report multifamily affordable units does not apply to the covered loan or application that your institution is reporting.

c. Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting Multifamily Affordable Units.

Code 1—Submitted directly to your institution

Code 2—Not submitted directly to your institution

Code 3—Not applicable

a. Use Code 3 if the requirement to report whether the applicant or borrower submitted the application directly to your institution does not apply to the covered loan or application that your institution is reporting.

b. Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Submission of Application.

Code 1—Initially payable to your institution

Code 2—Not initially payable to your institution

Code 3—Not applicable

a. Use Code 3 if the requirement to report whether the obligation arising from the covered loan was, or, in the case of an application, would have been, initially payable to your institution does not apply to the covered loan or application that your institution is reporting.

b. Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Initially Payable to Your Institution.

Enter the Nationwide Mortgage Licensing System and Registry mortgage loan originator unique identifier (NMLSR ID) for the mortgage loan originator, NA, or Exempt. The NMLSR ID should not include zeros that are not part of the NMLSR ID (e.g., if the NMLSR ID is 64573, it should be entered as 64573, not 00064573). The HMDA Platform can accept a value with, at most, nine integers (e.g., 214748364).

Example: If the NMLSR ID for the mortgage loan originator is 123450, enter 123450.

Enter "Exempt" if, pursuant to the 2018 HMDA Rule, your institution is not reporting NMLSR ID. 11.

Code 1—Desktop Underwriter (DU)

Code 2—Loan Prospector (LP) or Loan Product Advisor

Code 3—Technology Open to Approved Lenders (TOTAL) Scorecard

Code 4—Guaranteed Underwriting System (GUS)

Code 6—Not applicable

Code 7—Internal Proprietary System

a. If fewer than five (5) automated underwriting systems were used by your institution to evaluate the application, leave the remaining Automated Underwriting System data fields blank.

b. Use Code 1111 if, pursuant to the 2018 HMDA Rule, your institution is not reporting Automated Underwriting System.

c. Use Code 5 if your institution uses an Automated Underwriting System that 1) is not listed in the enumerated Automated Underwriting Systems, and 2) is not an internal proprietary system. Enter the name of the Automated Underwriting System in the Automated Underwriting System Conditional Free Form Text Field for Code 5 data field.

d. Use Code 6 if the requirement to report an AUS does not apply to the covered loan or application that your institution is reporting. Leave the remaining Automated Underwriting System data fields blank.

e. Use Code 7 if your institution uses an Automated Underwriting System that 1) is not listed in the enumerated Automated Underwriting Systems, and 2) is an internal proprietary system.